New Zealand avocado production is expected to see an uptick in production volumes after a challenging two years, according to a new report by food and agri banking specialist Rabobank.

In the new report Global Avocado Update 2025, Rabobank says after significant crop losses in 2023 due to Cyclone Gabrielle, New Zealand’s avocado industry saw a strong recovery in the 2024 calendar year.

“Improved growing conditions have supported a rebound in production, and industry sentiment has turned positive,” report co-author RaboResearch senior analyst Jen Corkran said.

“Despite a 17% decline in planted area in 2024, NZ Avocado forecasts a production increase of around 2 million trays (approx. 11,000 metric tons) for the 2024/25 season compared to 2023/24.”

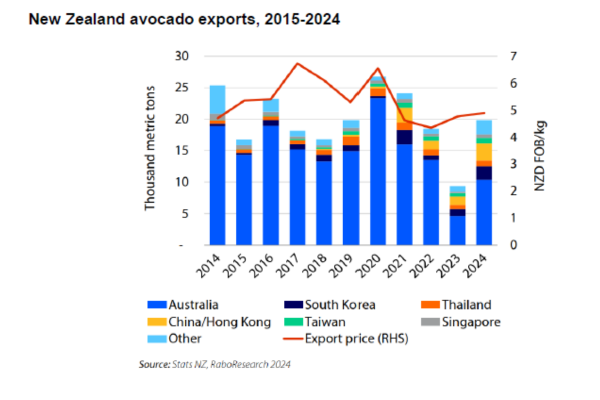

Ms Corkran said NZ Avocado revised its export strategy for 2025 with the aim of better aligning supply with offshore demand and improving grower returns.

“This strategy revamp appears to have paid dividends in the early months of 2025 with export returns from January to April 2025 rising 162% year-on-year to 2,944 metric tons, led by a 1,366-ton increase to the key Australian market,” she said.

Global markets

Meanwhile, the report says, the world’s appetite for avocados continues to grow at a rapid rate, with an average annual market value – in terms of consumer prices – now estimated at USD 20.5 billion (~ NZD 34 billion).

RaboResearch senior horticulture analyst David Magaña said three main regions represented 88 per cent of this market value – Latin America, North America and Europe.

While Latin America leads global consumption, the market value in the rest of the world is still low (at 12 per cent), he said, presenting opportunities for growth.

North America had seen a significant increase in avocado demand growth in the past two decades, led by marketing campaigns.

Globally, avocado export volumes are growing rapidly, RaboResearch said, driven by increased production and diversification of exporting countries. “Amid this rise of new suppliers, seasonal oversupply in certain markets is a concern that will require continued demand creation and marketing strategies,” it said.

RaboResearch expects global avocado exports to continue to expand in the next few seasons.

“We estimate global avocado exports will surpass three million metric tons by 2026/27, a significant increase from one million metric tons in 2012/13,” Mr Magaña said. “This massive growth is the result of increasing exports from the current top three avocado exporters – Mexico, Peru and Colombia – accounting for about two-thirds of global exports.”

Another factor, the report says, is the continued diversification of growing regions and the appearance of new exporting countries. Attracted by high margins in recent decades, new players are producing and exporting avocados, although pressure on margins is growing, it says.

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.