New Zealand farmer confidence rises from the depths

Results at a Glance

- Farmer confidence has increased but remains deep in negative territory overall.

- Sheep and beef farmers and horticulturalists are now more optimistic about the prospects for the agricultural economy, while dairy farmers are more pessimistic.

- Overseas markets (54 per cent), demand (34 per cent) and rising commodity prices (31 per cent) were shown to be the major sources of farmer optimism with rising input costs (65 per cent) and government policy (53 per cent) the major sources of concern.

- Farmers’ confidence in their own farm business performance is slightly higher. Growers continue to be the most optimistic about their own business performance with dairy farmers now the least confident.

- Farmers’ self-assessment of their own farm business viability marginally improved.

CEO, Rabobank NZ, Todd Charteris

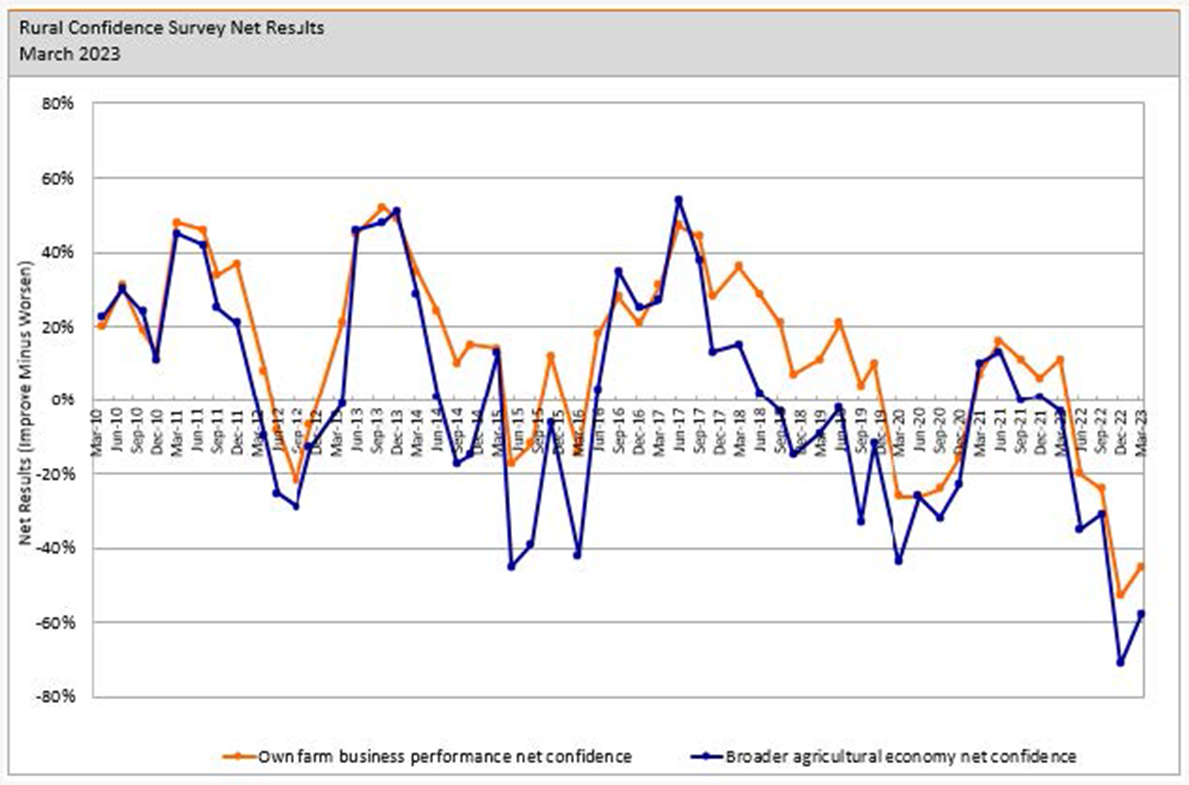

After dropping to an historic low in late 2022, New Zealand farmer sentiment has now crept higher, the first quarterly Rabobank Rural Confidence Survey of the year has found. However, rural confidence remains deep in negative territory overall with only one in 20 farmers holding an optimistic view on the prospects for the agricultural economy in the year ahead.

The latest survey — completed late last month — found farmer confidence was up on the previous quarter (Dec 2022), with the net confidence reading rising to -58 per cent, from -71 per cent previously.

The latest survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had risen to five per cent (from four per cent in the previous quarter) while the percentage expecting conditions to worsen fell to 63 per cent (down from 75 per cent). A total of 31 per cent were anticipating the agricultural economy to remain stable (up from 19 per cent previously).

Rabobank New Zealand CEO Todd Charteris said the uptick in confidence came despite incredibly challenging climatic conditions for many of New Zealand’s primary producers during the early part of 2023.

“With Cyclone Gabrielle battering much of the North Island in February, and parts of the lower South Island impacted by drought in recent months, it really has been a tough start to the year for the country’s farmers and growers,” he said.

“And while sector confidence is still very low, it is pleasing to see it heading in the right direction.”

Mr Charteris said the higher confidence in the broader agri economy had been driven by improved sentiment among sheep and beef farmers and horticulturalists.

“The catalyst for this improved sentiment among sheep and beef farmers has been improved demand for New Zealand’s red meat exports from the Chinese market following the abandonment of China’s Zero-Covid policy late last year and subsequent reopening of their food service sector,” he said.

“This has played a key role in the recent improvement in schedule prices for both beef and lamb which have now bounced back after a dip late last year.

“For growers, while we’ve seen the inclement weather disrupt production in several regions over recent months, we’ve also seen demand for fruit and vegetables in both domestic and international markets remain strong, and this has helped to hold up prices.”

On the other hand, Mr Charteris said, dairy farmers were now even more pessimistic about the broader agri economy than they were last quarter.

“Demand out of China has been a little slower to return for dairy products than it has for other food products, and we’ve also seen increased global dairy supply act as a constraint on global dairy prices in the early part of the year,” he said.

“As a result, Fonterra revised their milk price forecast lower in late February, and then again earlier this week. And the prospect of a lower payout, coupled with ongoing elevated farm input prices, has further eroded the already dwindling confidence of the country’s dairy farmers.”

Among farmers with an optimistic outlook across all sectors, the survey found overseas markets (54 per cent), demand (34 per cent) and rising commodity prices (31 per cent) were the major sources of optimism. For those with a pessimistic outlook, rising input costs (65 per cent) and government policy (53 per cent) continued to be the major concerns.

“Farm input prices have been a key concern for a number of quarters now and have remained stubbornly high over recent months. However, we are seeing some softening of key farm input prices in global markets – particularly for fertiliser – and we do expect this to filter through to New Zealand prices in the near term,” Mr Charteris said.

“This survey also found 26 per cent of farmers with a negative outlook nominating ‘other’ factors as a reason for holding a pessimistic view on the agri economy, and this quarter we saw labour issues cited frequently in the verbatim responses as well as several new concerns including weather events and economic recession.”

Own farm business performance

Farmers’ confidence in their own farm business performance was up marginally on last quarter with the net reading rising to -45 per cent from -53 per cent previously.

“As with confidence in the broader economy, the latest survey found sheep and beef farmers as well as growers more upbeat in the prospects for their own businesses, with dairy farmers now more pessimistic,” Mr Charteris said.

“Growers continue to be the most positive about the year ahead, while dairy farmers are now the gloomiest – and you have to go all the way back to 2006 to find a lower result for dairy farmers on this measure.”

Farm Investment and viability

Mr Charteris said farmer investment intentions were back slightly from last quarter while farm business viability marginally improved.

“Positively, this survey found the proportion of farmers rating their own business as ‘easily viable’, ‘viable’ or ‘just viable’ was up to 95 percent (from 94 percent previously),” he said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

Rabobank New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of about 10 million clients worldwide through a network of close to 1000 offices and branches. Rabobank New Zealand is one of the country's leading agricultural lenders and a significant provider of business and corporate banking and financial services to the New Zealand food and agribusiness sector. The bank has 32 offices throughout New Zealand.

Media contacts:

David Johnston

Media Relations Manager

Rabobank New Zealand

Phone: 04 819 2711 or 027 477 8153

Email: david.johnston@rabobank.com

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: +612 8115 2744 or +61 2 439 603 525

Email: denise.shaw@rabobank.com