The service at a glance

Confirmation of Payee checks whether the name of the person or business you intend to pay matches their account number with their bank, giving you greater confidence that you are paying the right person or business.

The service applies to payments made between New Zealand bank accounts.

How Confirmation of Payee works

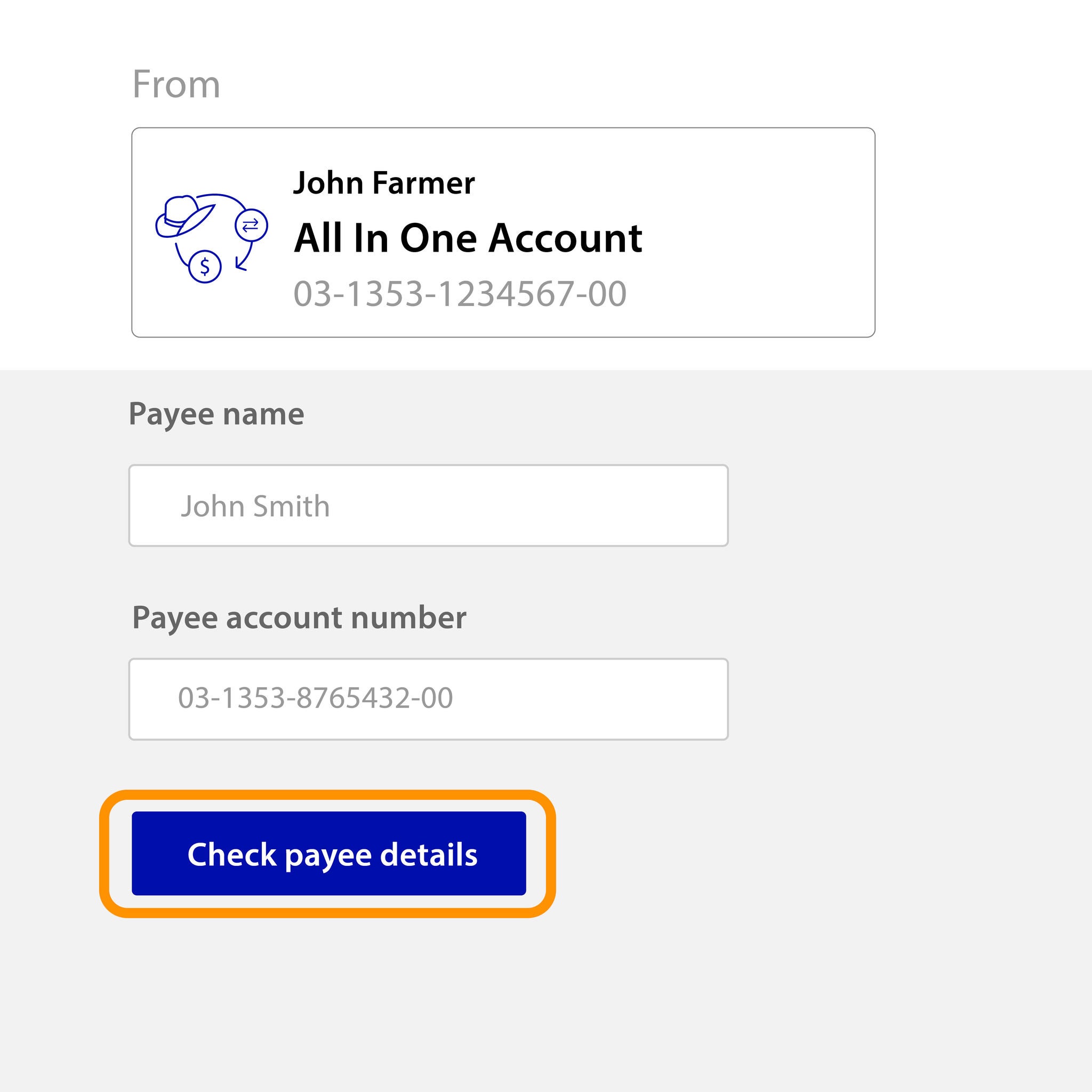

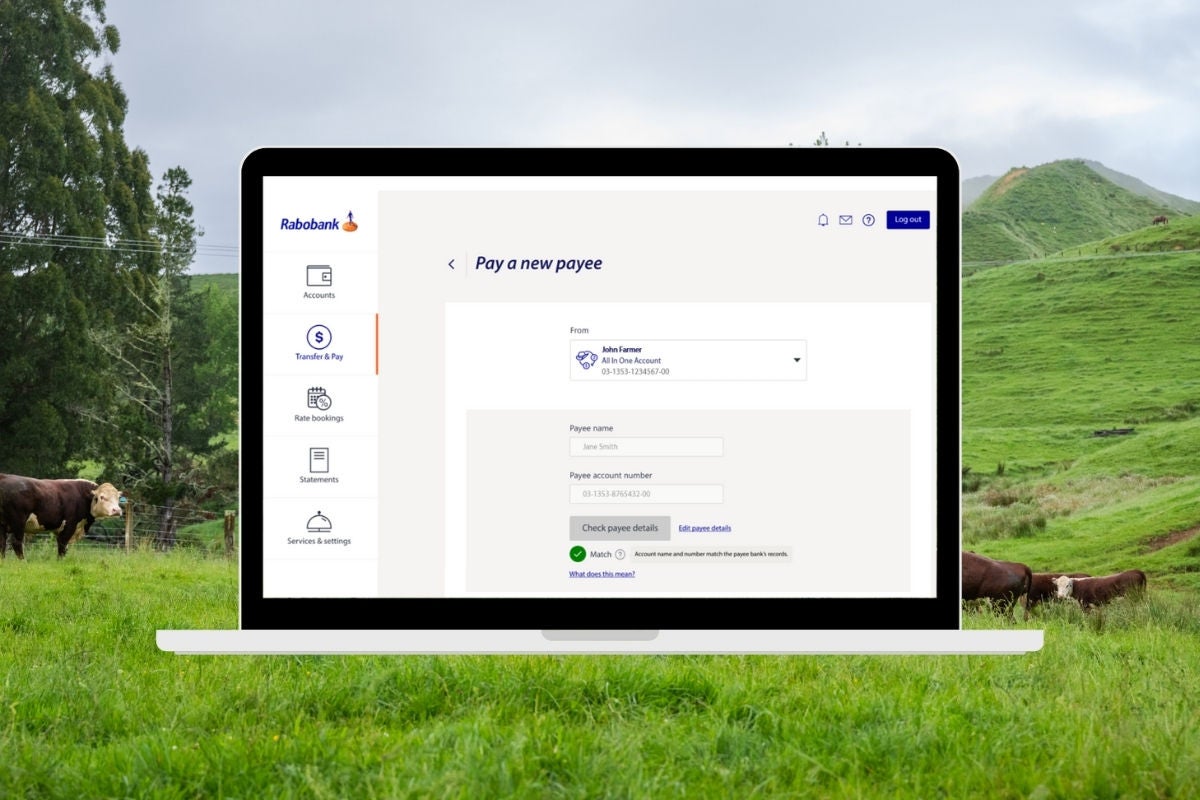

When you pay a new payee or edit an existing payee using internet banking or the mobile app, you will see a ‘check payee details’ button. Once selected, the payee’s name will be checked against the payee’s account number with their bank.

The check will then return one of the following responses:

Where we have been unable to match the payee's details with their bank's records, it is up to you to decide if you want to proceed with the payment.

For payees saved before 1 December 2024

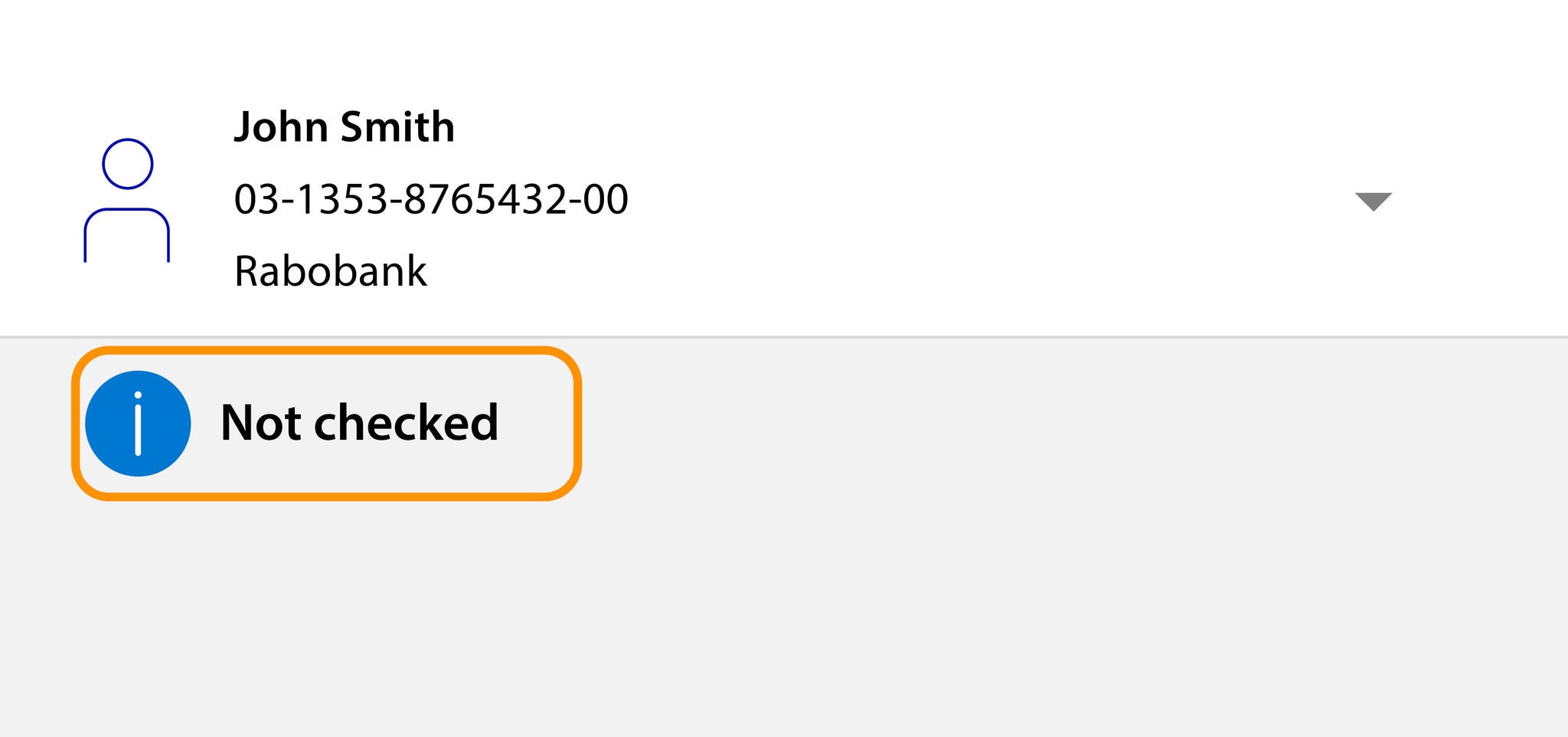

A ‘Not checked’ status will be displayed (as below) for all payees saved before 1 December 2024. To run a Confirmation of Payee check for these saved payees, click ‘Edit payee details’ and then select the ‘Check payee details’ button.

Disclaimer: You will still be liable for any losses you incur if you pay the money to the wrong person or business. Payments made to the wrong account may not be recoverable. Rabobank does not accept liability for any information you, another bank or another party provides to perform the Confirmation of Payee check.

Making payments

The way you make payments via internet or mobile banking won’t change, however Confirmation of Payee will allow you to check if the name of the account holder you intend to pay matches their account number with their bank.

To receive a match result you will need to enter:

The payee’s account name as shown in their bank’s records; and

The payee’s account number.

If you do not know the payee’s account name, you will need to confirm it with the payee in order to get a match. It is important to make sure you know and trust the person you are paying. As a reminder, where we have been unable to match the details with the payee’s bank it is up to you to decide if you want to proceed with the payment.

It is important to remember

Money sent to the wrong account may not recoverable.

Always be wary if you’re told to ignore a ‘not a match’ response by the payee.

- If you are checking the details with the payee, contact them using a phone number that you trust to confirm their details. Never use a phone number from an email or text message exchange as these can be manipulated by scammers.

- Always take the time to question the purpose of the transaction and the trustworthiness of the recipient before making a payment.

- The Confirmation of Payee check will only be performed on payments made between New Zealand bank accounts using internet banking and the mobile app.

- The Confirmation of Payee check will not be performed on payments which involve: staff-assisted payments (e.g. branch, phone, email) or international or overseas payments. We encourage you to remain vigilant when making International or overseas payments in order to keep yourself safe from possible scams and fraud.

Receiving payments

If you are receiving a payment from someone else, you will need to provide them with your account name and account number.

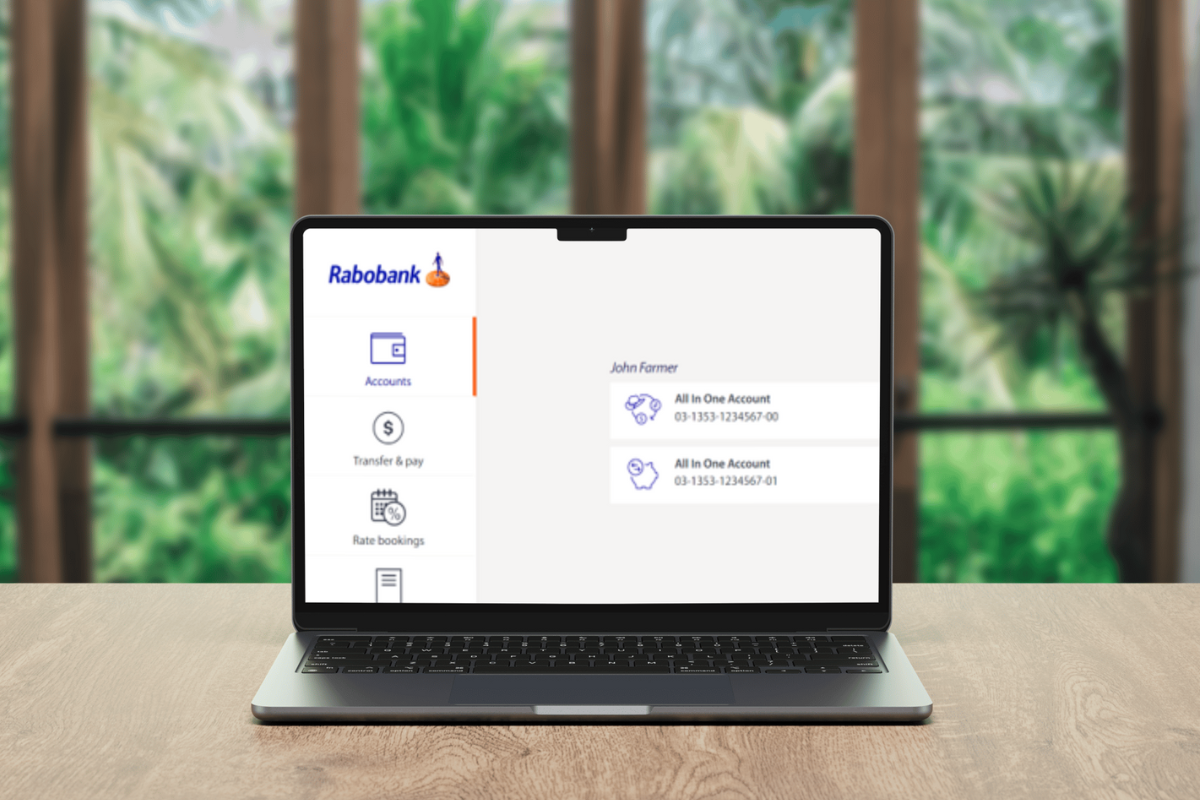

To find your account details log into your internet banking or mobile app and click on the ‘Accounts’ tab. Here you will find the ‘Account Name’ and ‘Account Number’ for each of your accounts.

You can also find your account details at the top of your bank statement.

Stay alert to scams

It is still important that you remain vigilant for scams. You will still be liable for any losses you incur if you pay the money to the wrong person or business. Payments made to the wrong account may not be recoverable.

You should be wary of fraudsters attempting to impersonate banks. If your receive a call about Confirmation of Payee from someone claiming to be from Rabobank, hang up and Contact Us. For more information about how to protect yourself, visit the Get Verified website.

Frequently Asked Questions

General

Confirmation of Payee is a new service that checks if the name of the account holder you intend to pay matches their account number with their bank, giving you greater confidence that you’re paying the right person or business. It can also help reduce the risk of being scammed.

A payee is the term used to describe the person or business that you are paying money to.

The Confirmation of Payee service will be available from 1 December 2024.

When you pay a new payee or edit an existing payee using internet banking or mobile app, the payee’s name will be checked against the payee’s account number with their bank. You will then receive a response telling you if the details you’ve entered match.

Our priority is to keep your money safe and secure.

Confirming the payee’s name and account number match helps:

Give you greater confidence that you are paying the right person or business

Reduce the risk of making a mistake when making a payment

Provide protection against scams and fraud by adding an additional layer of security to the payment process

Yes, the Confirmation of Payee check is a mandatory step when:

Adding a new payee;

Editing a payee; or

Making a payment to a new payee

However, regardless of the result, it will not stop you from making a payment. If the service is unable to match the details with the payee’s bank, it is up to you to decide whether you want to proceed with the payment.

Please note: If you are only editing optional fields (e.g., reference or particulars) for a saved payee, the Confirmation of Payee check is not mandatory. You can still choose to perform the check by selecting the "Edit Payee Details" button followed by the "Check Payee Details" button.

The Confirmation of Payee check will only be performed on payments made between New Zealand bank accounts using internet banking and the mobile app.

It will not be performed on payments which involve:

Staff-assisted payments (e.g. branch, phone, email); or

International or overseas payments.

There are six possible response types:

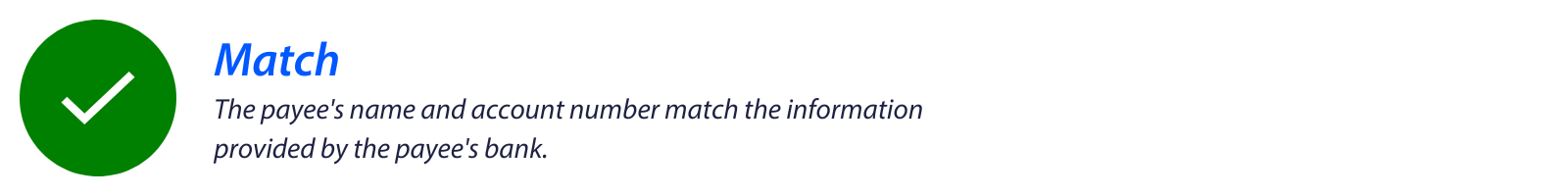

| ‘Match’ The payee's name and account number match the information provided by the payee's bank. |

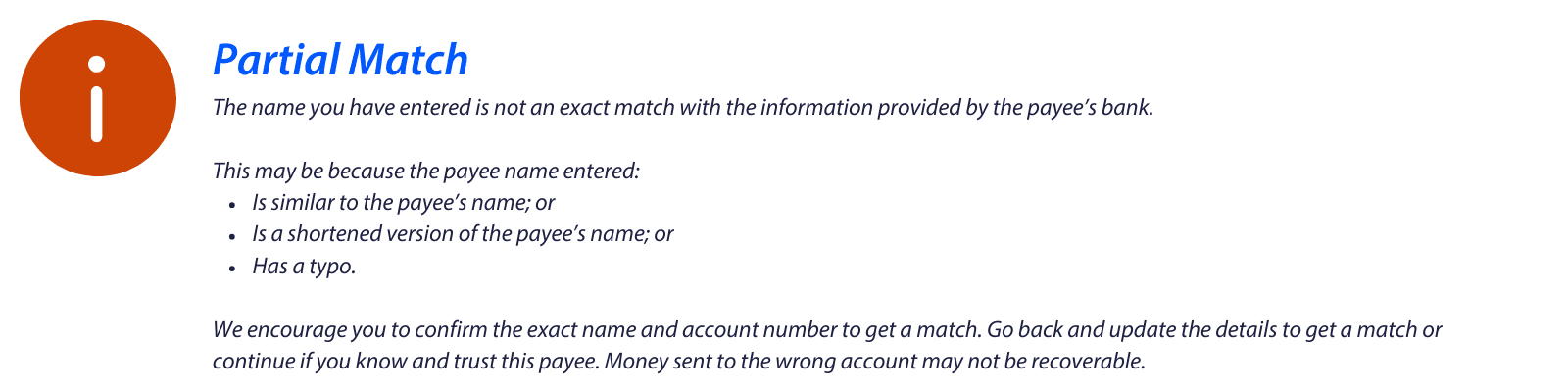

‘Partial match’ The name you have entered is not an exact match with the information provided by the payee’s bank. This may be because the payee name entered:

We encourage you to confirm the exact name and account number to get a match. Go back and update the details to get a match or continue if you know and trust this payee. Money sent to the wrong account may not be recoverable. | |

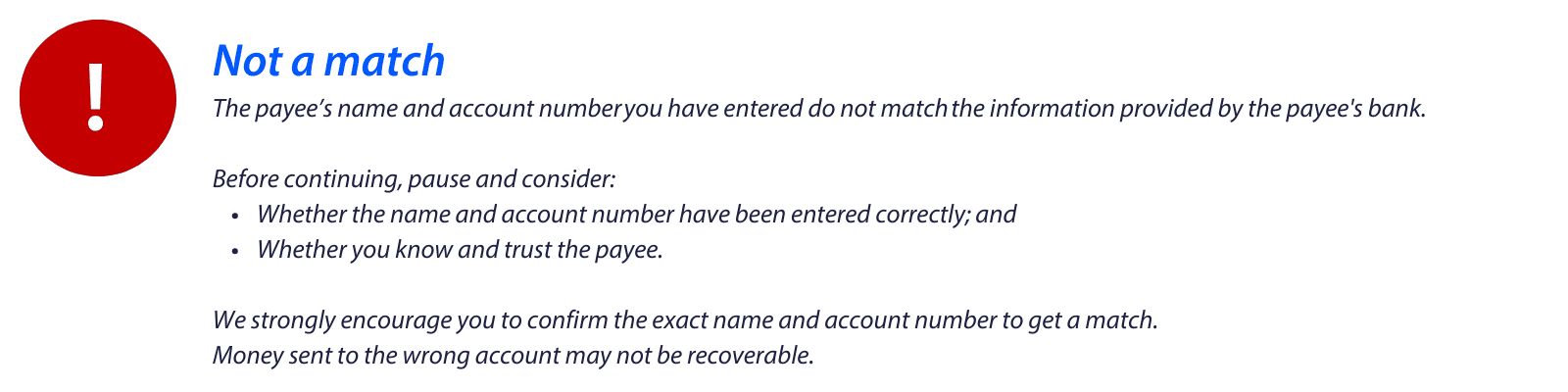

‘Not a match’ The payee’s name and account number you have entered do not match the information provided by the payee's bank. Before continuing, pause and consider:

We strongly encourage you to confirm the exact name and account number to get a match. Money sent to the wrong account may not be recoverable. | |

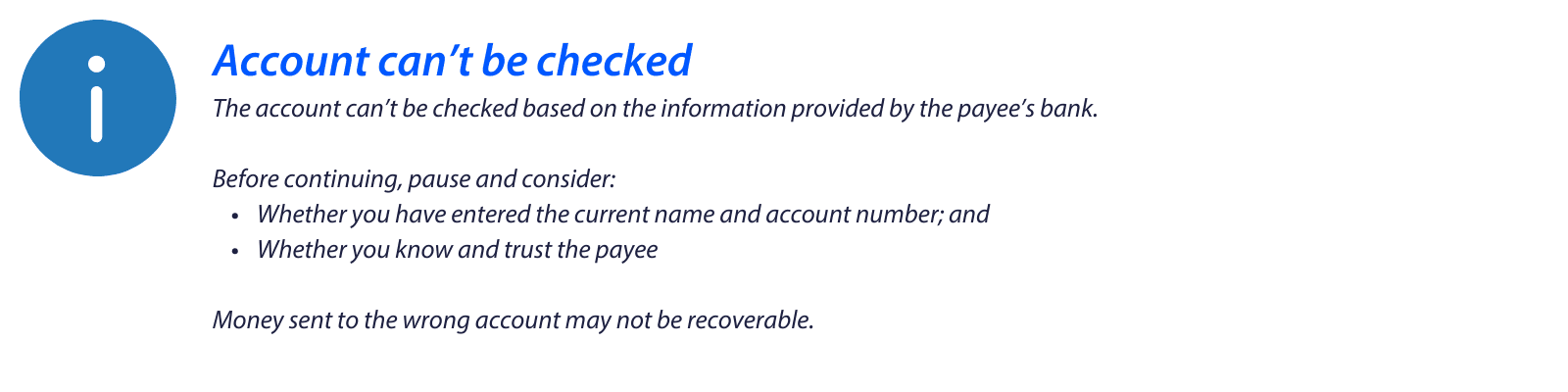

| Account can’t be checked’ The account can’t be checked based on the information provided by the payee’s bank. Before continuing, pause and consider:

Money sent to the wrong account may not be recoverable. |

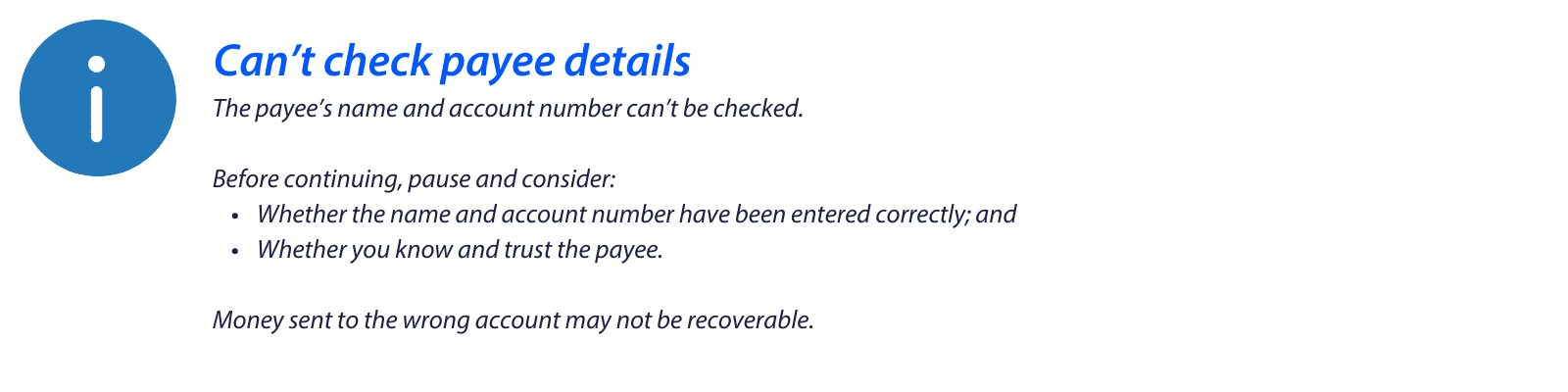

‘Can’t check payee details’ The payee’s name and account number can’t be checked. Before continuing, pause and consider:

Money sent to the wrong account may not be recoverable. | |

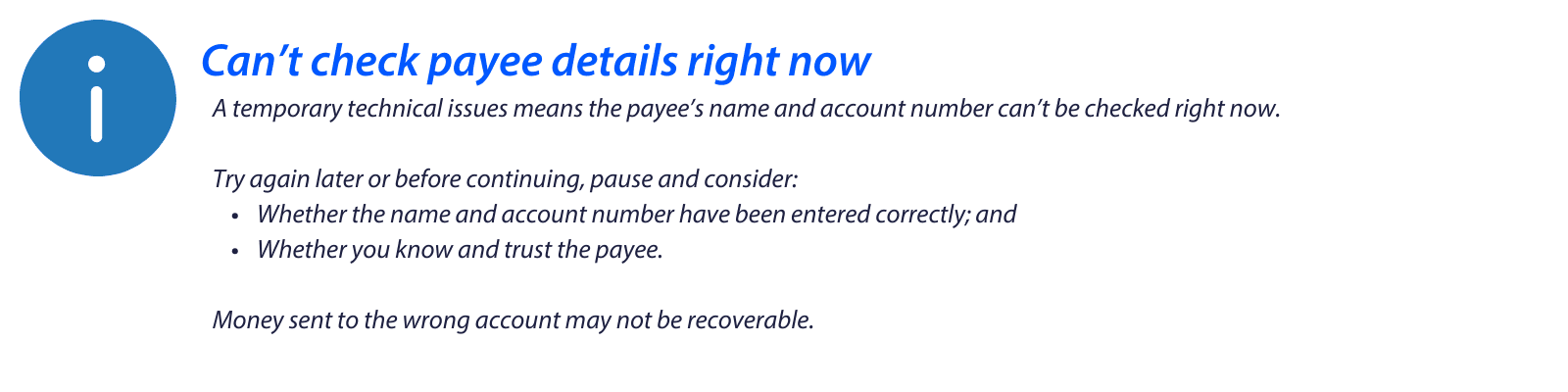

‘Can’t check payee details right now’ A temporary technical issues means the payee’s name and account number can’t be checked right now. Try again later or before continuing, pause and consider:

Money sent to the wrong account may not be recoverable. |

Once the ‘Check payee details’ button is clicked, a result will be returned within a few seconds.

Confirmation of Payee is not mandatory; however, the majority of New Zealand banks will be implementing it. The implementation date may vary between banks.

If you are paying someone whose bank has not yet implemented Confirmation of Payee, you will receive the ‘Can’t check payee details’ response. For more information, see What are the possible responses from the Confirmation of Payee check?

You can find out more about the roll out of Confirmation of Payee in New Zealand by visiting www.getverified.co.nz

Making payments

If the details you enter are incorrect and the funds are sent to the wrong account, the funds may not be recoverable.

At this stage, you can only save a payee's details without making a payment if you log into your internet banking through a web browser.

Go back and edit the payee’s details before proceeding with the payment.

If the payee’s name contains special characters, you can use the corresponding letter instead (e.g. e, c, i, n instead of É, ç, î, ñ etc.)

No, it is up to you to decide whether you want to proceed with the payment. Remember, you will still be liable for any losses you incur if you pay the money to the wrong person or business. Payments made to the wrong account may not be recoverable. Rabobank does not accept liability for any information provided by a payee’s bank to Rabobank or if you choose to proceed with a payment that is not a match.

Before deciding whether you wish to proceed with the payment, pause and consider:

Whether the name and account number have been entered correctly; and

Whether you know and trust the payee.

Remember:

- Money sent to the wrong account may not recoverable.

- Always be wary if you’re told to ignore a ‘not a match’ response by the payee.

- If you are checking the details with the payee, contact them using a phone number that you trust to confirm their details. Never use a phone number from an email or text message exchange as these can be manipulated by scammers.

- Always take the time to question the purpose of the transaction and the trustworthiness of the recipient before making a payment.

The Confirmation of Payee check result will be saved against the payee.

Please note: A ‘Not checked’ status will be displayed for all payees saved before 1 December 2024. To run a Confirmation of Payee check for these saved payees, click ‘Edit payee details’ and then select the ‘Check payee details’ button.

Receiving payments

Check with them that they’ve entered your account name exactly as it appears in your internet banking, mobile app or on your bank statement, and that they haven’t abbreviated your name or added/removed spaces.

You can find your account name and number under the ‘Accounts’ tab in both your internet banking and mobile app. You can also find your account name and number at the top of your bank statement.