Beef mince’s long-standing position as the ‘budget-conscious’ red meat option is now under serious threat, with its retail price increasing rapidly over the past 12 months.

RaboResearch senior animal protein analyst Jen Corkran said prices for all food products had risen strongly of late, and beef mince was one of the key contributors to high food price inflation.

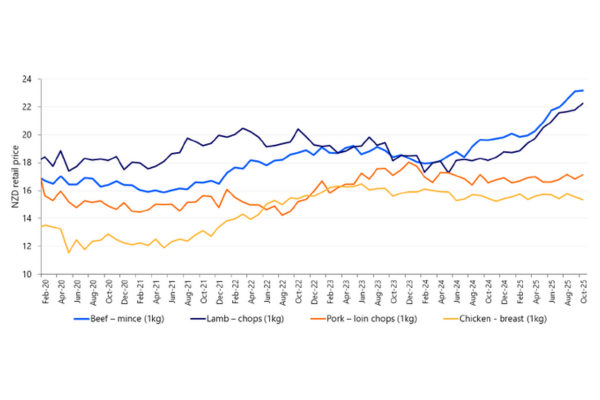

“The latest Selected Price Indexes (SPI) data from Statistics New Zealand found annual food prices jumped by 4.7% in the year to October, but this pales in comparison to the 18%1 rise in the average price of a 1 kilogram pack of beef mince that we’ve seen over the same period,” she said.

“Beef mince is currently averaging $23.17 per kilo, making it slightly more expensive than lamb chops at $22.27 per kilo, and this is a trend that has persisted for most of the past 18 months. This is despite significant increases in lamb prices over that same period, particularly in 2025, with lamb chop retail prices having also climbed steadily this year.

NZ retail price for selected meats

“Beef mince is also priced higher than other popular proteins, including chicken breast at $15.33 per kilo and pork loin chops at $16.15 per kilo.

“While red meat generally commands a premium, beef mince has traditionally been the most affordable red meat option for consumers. Over the past two months however, the gap between beef mince and these alternatives is as wide as it has been at any point in the past.

“These continued price hikes will undoubtedly be altering the perception of beef mince and weighing on the decisions consumers make when it comes to meat purchases.”

US market dynamics driving strong beef pricing

Ms Corkran said prices for beef were high across the globe and this was largely being driven by supply and demand dynamics in the US – one of the world’s largest beef importers.

“The US beef herd is currently in a rebuilding phase which means there are fewer cull cows being processed domestically in the US,” she said.

“As a result, there is less beef being produced in the US, and this has flowed through to hot US demand for beef out of New Zealand and Australia.

“In particular, due to the lack of domestic volume, US demand is incredibly high for lean grinding beef and the US are importing significant volumes of this which they then blend with locally-sourced fatty feedlot beef to produce hamburgers.

“Across the past 12 months, about 40% of New Zealand’s beef exports have gone to the US – up from just under 34% in the 22/23 export season.”

Ms Corkran said strong US demand and import prices had pushed the average export price for New Zealand beef to record highs, and this was filtering through to elevated domestic pricing.

“New Zealand’s relatively small domestic market means the vast majority of our beef (roughly 80%) is exported,” she said.

“This means that when export prices surge – driven by strong overseas demand for the very type of beef used in beef mince – domestic prices inevitably rise, as New Zealand consumers are competing with what international buyers are prepared to pay.

“The current scenario with beef mince is actually pretty similar to what we’ve seen with the likes of domestic butter and cheese prices, where surging global prices for these products earlier this year pushed up the cost of these items in local supermarkets.”

Short to medium term outlook

Looking ahead, Ms Corkran said, strong US demand is expected to persist as the country’s herd rebuild will take time, keeping its need for imports elevated.

“For New Zealand farmers and beef producers, this points to continued higher-than-average farmgate returns. However, it also means retail beef prices are likely to remain firm over the next couple of years,” she said.

“The key question is how consumers respond. Historically, when red meat prices climb, shoppers tend to trade down to cheaper proteins like chicken or pork.

“We’re already seeing this trend overseas, with quick-service restaurants expanding chicken offerings as beef costs rise. If this pattern accelerates locally, it could signal that beef pricing has reached its ceiling, potentially easing prices slightly in the longer term.”

1Stats New Zealand, RaboResearch 2025

RaboResearch Disclaimer: Please refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.