The global animal protein industry is set to experience a slowdown in production growth in 2026, driven by both cyclical and structural factors, according to a new report by food and agribusiness banking specialist Rabobank.

In its Global Animal Protein Outlook for 2026, Rabobank says growth in global animal protein production will continue to slow in 2026.

“Seafood and poultry will emerge as the primary drivers of production growth, while pork and beef production are expected to contract, marking the first reduction in global terrestrial (land-based) species output in six years,” the report says.

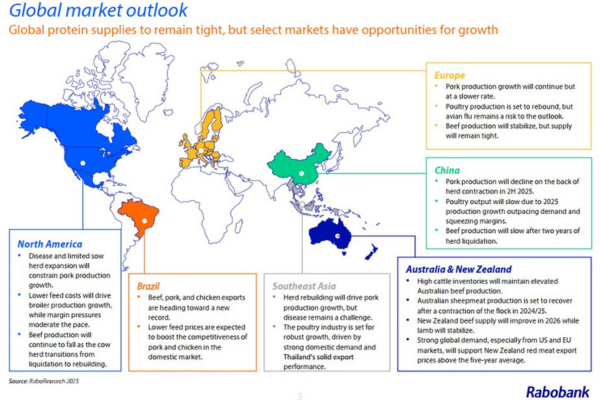

This slowdown, the report says, is influenced by both cyclical factors, such as shifts in North American and Brazilian cattle markets, and structural factors, like China’s efforts to rebalance its pork market.

Industry could face rising costs… and pressured margins

“While we expect feed costs to remain steady, lower protein supplies, rising volatility and trade costs, and disease pressure will weigh on margins,” Global Strategist Animal Protein for RaboResearch, Éva Gocsik said.

“Processors may face ongoing challenges around capacity utilisation, as well as trade disruptions resulting from tariffs and other protectionist measures. All of this could raise costs, pressure demand, and ultimately squeeze margins. In both mature and developing markets, a focus on increasing efficiency and productivity will be critical at the farm and processor level,” she said.

Economic and consumer dynamics point to price sensitivity

According to Ms Gocsik, with global gross domestic product growth projected to decelerate, consumers are likely to become increasingly price-sensitive, altering their consumption patterns. At the same time, the rising use of glucagon-like peptide-1 agonists (GLP-1s) is also likely to influence dietary choices.

“Price pressures within animal protein categories may lead consumers to trade down or switch between proteins, while consumers seeking protein-rich foods will potentially boost animal protein demand,” she said.

Global trade shows resilience amid disruption and uncertainty

Despite disruptions, the report says, animal protein trade has shown resilience, with strategic front-loading, like shipments of Brazilian beef into the US, helping to sustain volumes amid volatility and shifting tariffs that are reshaping global flows.

“Meanwhile, supply-demand imbalances continue to seek equilibrium, a trend that is likely to persist in 2026. Geopolitical tensions and evolving policies will continue to influence trade, but new trade agreements may provide a boost,” the report says.

The report says disease outbreaks have also disrupted trade, squeezed margins, and pressured productivity.

“Disease outbreaks such as African swine fever and avian influenza continue to disrupt trade and squeeze margins. Combined with emerging diseases like New World screwworm and Bluetongue, these challenges are driving greater adoption of biosecurity measures and increased focus on new approaches to managing disease pressure, though implementation remains complex,” it says.

Sustainability is key to risk management, and technology offers solutions

In an uncertain operating environment, the report says, sustainability-related risks linked to climate and nature are increasingly critical.

“Regulatory momentum is pushing sustainability to the forefront of strategic planning for animal protein companies. Technology, particularly artificial intelligence, offers potential benefits for managing operational risks and advancing sustainability goals, though investment remains weak,” it says.

While not all AI applications will transform the industry, the report says, strategic integration into existing workflows could spark meaningful progress in a sector that is traditionally slow to adopt new technologies.

“Maintaining consumer trust is paramount. In times of heightened risk, consumers continue to prioritize animal welfare, supply availability, price, food safety, and quality, and these demands are driving advancements in transparency and traceability,” Ms Gocsik said.

New Zealand outlook

The report says New Zealand’s red meat supply is poised for a measured, slow recovery.

“Beef head count is forecast to rise by around 3% in 2026 following a subdued 2025, which saw slaughter decrease 5% year-on-year,” RaboResearch senior animal protein analyst Jen Corkran said.

“On the sheep side, Beef + Lamb New Zealand forecast ewe numbers to decline by 1.9% in 2026, bringing the national flock to just over 14 million.

“Though sheep inventory remains tight, we expect some stabilisation into 2026, particularly in lamb kill, which should match 2025 at just over 17 million head.

“With beef production set to rise slowly and sheep inventory potentially stabilising, local supply conditions are expected to improve.”

Ms Corkran said global demand for New Zealand red meat is anticipated to remain robust in 2026 supporting strong pricing for Kiwi beef and lamb.

“In 2025, average beef export prices have been significantly above the five-year average, and while some easing from the current record highs is possible, strong demand and firm pricing are expected to continue into 2026,” she said.

“The US remains the key market for New Zealand beef, accounting for 40% of volumeand 44% of volume in the total 2024/25 New Zealand export season.

“Lamb prices are also expected to remain steady and above the five-year average in2026.

“While sheepmeat volumes to China have softened over the last two years, lambexports to the EU and US, and to a lesser extent the UK, are helping buffer relianceon this market. Sheepmeat prices are also likely to be supported by reducedcompetition from Australia.”

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.