Results at a glance

- Farmer confidence in the broader agri economy has dipped further into negative territory following consecutive increases in the previous two quarters.

- This fall comes despite a lift in farmers’ expectations for their own businesses with primary producers across all sectors now more optimistic about the prospects for their own farm business performance.

- Sheep and beef farmers remain the most pessimistic about the performance of their own businesses, but recorded the largest rise on this measure.

- The number of farmers self-assessing their own farm business as unviable decreased from last quarter and now sits at seven per cent (nine per cent previously).

Todd Charteris, CEO, Rabobank New Zealand

- Among farmers with a negative outlook on the agri economy, higher input prices (56 per cent), lower commodity prices (40 per cent), and rising interest rates (37 per cent) were the major sources of concern. Rising commodity prices (36 per cent), government intervention/ policies (24 per cent) and increasing demand (23 per cent) were the top three reasons identified by those looking favourably at the year ahead.

- The net reading for farmer investment intentions also rose marginally but remains at net negative levels overall.

Despite improved confidence in the performance of their own operations, farmers are now more pessimistic about the prospects for the broader agri economy, the latest Rabobank Rural Confidence Survey has found.

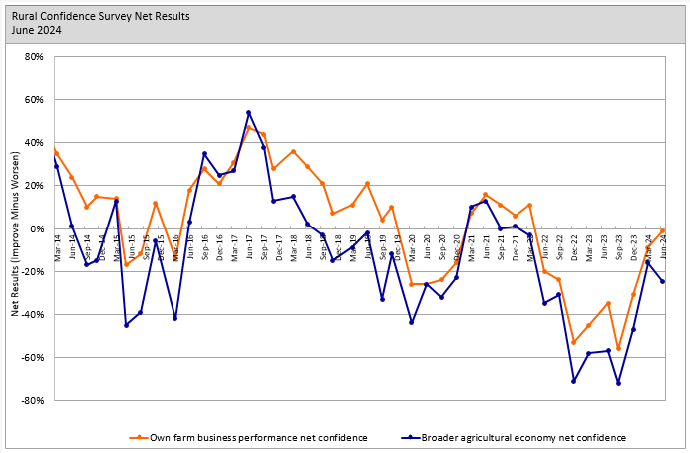

After rising strongly in the previous two quarters, the latest survey — completed earlier this month — found farmer confidence in the broader agri economy had reversed course, falling to a net reading of -25 per cent from -16 per cent previously. Conversely, farmers’ expectations for their own business performance improved, with the net reading climbing to – one per cent from - nine per cent previously.

Rabobank CEO Todd Charteris said the latest survey had thrown up a ‘mixed bag’ of results.

“It’s obviously disappointing to see headline confidence fall, but there were several positives in the results, with the major plus being the uplift in farmers’ confidence in the performance of their own businesses,” he said.

“We generally do see the reading for farmers’ confidence in their own businesses sitting a little higher than for the broader agri economy, but the two measures do almost always move in the same direction, so it is a bit unusual to see them taking divergent paths this quarter.

“It is hard to put a finger on why this is the case, but one possible reason might be that farmer concerns about the prospects for New Zealand’s overall economy are feeding into pessimism about the prospects for the agri economy – and we did see a few comments in the verbatim responses to the agri economy question that support this view.”

Regardless of the reason, Mr Charteris said, what was clear was farmer sentiment remains subdued and had been for an extended period of time.

“Given the importance of the sector to the wider economy, it really is essential that everyone involved with the industry bands together to support the country’s food producers and to get things moving in the right direction,” he said.

“And that’s certainly the message I was getting from most of the farmers I spoke to at the National Fieldays last week.”

Key drivers of optimism and pessimism

Among farmers with a pessimistic outlook on the agri economy, the survey found higher input prices (56 per cent), lower commodity prices (40 per cent) and rising interest rates (37 per cent) were the three major reasons cited for holding this view.

“These three reasons were also the top of the list in quarter one, however the percentage of farmers citing each these factors is now marginally lower than it was three months ago,” Mr Charteris said.

Among those expecting conditions to improve, the report found, rising commodity prices was the major reason cited (by 36 per cent), while government /intervention policies (24 per cent) and increasing demand (23 per cent) were the other major reasons identified.

Own farm business performance by sector

The survey found farmers’ expectations for their own farm business operations were up across all sector groupings. Sheep and beef farmers recorded the most significant upwards lift (rising from a net reading of -31 per cent to -17 per cent) on this measure, while the net scores rose from + five per cent to +10 per cent for dairy farmers and from +23 per cent to +26 per cent for growers.

“Sentiment among sheep and beef farmers has been at dire levels over recent quarters. So it is encouraging to see this creeping upwards with this likely to be largely attributable to the strong pricing outlook for beef over the months ahead,” Mr Charteris said.

“It’s also good to see slight rises in confidence in their own businesses among dairy farmers and horticulturalists. Dairy farmers saw some healthy price rises at GDT auctions during May and early June which will have put a bit more of a spring in their step, while horticulturalists continue to see good growing conditions that are helping to set them up for good returns.”

Viability and investment intentions

The survey found farm viability was marginally improved from last quarter.

“Last quarter we saw nine per cent of farmers self-assessing their operations as ‘unviable’ with this now dropping to seven per cent,” Mr Charteris said.

“While at the top end, we’ve also seen a small lift in the proportion of farmers assessing their businesses as ‘easily viable’ with this up to 16 per cent this quarter from 14 per cent in March.”

The net reading for farmer investment intentions also rose marginally on last quarter with 14 per cent of farmers (16 per cent previously) saying they intended to increase investment and 23 percent (29 per cent previously) intending to decrease investment.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.