Results at a glance

• Farmer confidence remains elevated but has fallen from the near-record highs recorded earlier this year.

• Dairy farmers were the major contributor to weaker overall sentiment with their confidence in the broader agri economy significantly lower than in September

• Among farmers holding a negative outlook on the agri economy, ‘lower commodity prices’ (60%) was cited as the major source of pessimism, while ‘rising input costs’ (25%) was the next most prominent reason given.

• Rising commodity prices (59%) and overseas markets/ economies (21%) were the major reasons cited by farmers with an optimistic outlook.

• Farmers’ expectations of their own farm business performance over the next 12 months were also down from last quarter but remain strong overall. Sheep and beef farmers are now the most optimistic of all sector groupings about the prospects for their own businesses.

• Farmer investment intentions were higher than last quarter and are now at their highest level since mid-2017.

• Farmers’ expectations for land price values are also higher.

Rural Confidence Survey Net Results - December 2025

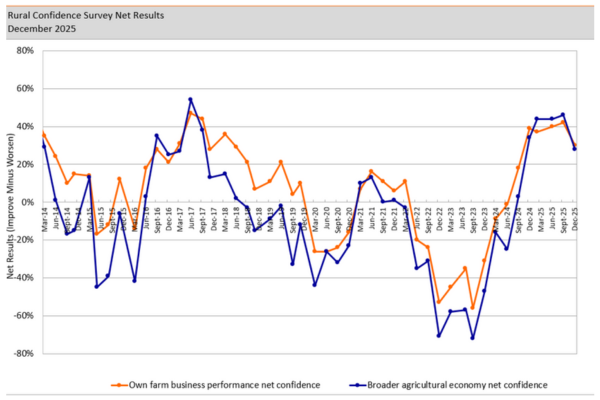

Farmer confidence remains elevated, but has fallen from the near-record highs recorded across the first three quarters of 2025, the fourth and final Rabobank Rural Confidence Survey of the year has found.

Following net readings in excess of +40% across the first three quarters of 2025, farmer confidence in the broader agricultural economy fell to a net reading of +28%.

The latest survey — completed late last month — found 40% of New Zealand farmers were now expecting the performance of the broader agri economy to improve in the year ahead (down from 51% in the previous quarter), while the number expecting conditions to worsen had risen to 12% (from 5% previously). The remaining 45% of farmers expected conditions to stay the same (43% previously).

While confidence was lower this quarter, Rabobank New Zealand CEO Todd Charteris said, it was important to put the latest result into context.

“The confidence readings across the first three quarters of the year have been incredibly high and, while confidence has come back a bit since September, it’s important to note the latest result is still very strong,” he said.

“We’ve still got four in 10 farmers expecting conditions in the broader agri economy to improve across the next 12 months, and positivity remains the dominant sentiment across the sector.”

Mr Charteris said the dip in sentiment this quarter had been driven by lower confidence among dairy farmers.

“Since our last survey in September, we’ve seen increased milk supply – both here in New Zealand and around the globe – result in string of falls at recent global GDT events as well as a downgrade in Fonterra’s pay-out forecast for the 2025/26 season,” he said.

“These developments have clearly weighed on dairy farmers, and their confidence in the outlook for the broader agri economy over the coming year was significantly lower this quarter than it was just three months ago.”

Mr Charteris said growers and sheep and beef farmers were now significantly more upbeat about the prospects for the agri economy than their dairy counterparts.

“Zespri’s counter seasonal global supply programme is now up and running and their latest forecast for the 2025/26 season is tipping record returns across all fruit groups,” he said.

“This is all great news for their growers, while the outlook for other horticultural industries this season also looks strong.

“Red meat producers are riding high too, with pricing for sheepmeat and beef elevated across recent months. And with global supply for both beef and sheepmeat tight, the expectation is that sheep and beef farmer incomes should stay strong in 2026.”

Among all farmers with a positive outlook on the agri economy, the survey found the major reason for holding this view was rising commodity prices (59%). Overseas markets/economies (21%) and falling interest rates (19%) were the next most frequently cited reasons.

For those with a negative outlook, falling commodity prices (67%) was the dominant reason cited, while rising input prices (25%), overseas markets/economies (23%) and government intervention policies (20%) were also prominent.

Mr Charteris said the latest confidence reading rounded out a year of exceptionally high farmer sentiment.

“In fact, if we look back across the 20-plus year history of the survey, we’ve never seen a calendar year with a higher average farmer confidence rating,” he said.

“Demand and pricing for all of New Zealand’s key agri exports has been incredibly strong across the year, and I think most across the industry will look back on 2025 as one where the stars largely aligned for the sector.”

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were also back from last quarter with the net reading falling to +30% from +42% previously.

As with the headline confidence reading, dairy farmers were the catalyst for the drop, falling to a net reading of +22% from +54 previously.

“Sheep and beef farmers are now the most optimistic about the prospects for their own businesses, holding at net reading of +53%, while we also saw a jump in the net reading for growers, with this lifting to +17% from +1% previously,” Mr Charteris said.

Investment intentions

The survey found New Zealand farmers’ investment intentions were higher than last quarter with 38% (33% previously) of farmers expecting to increase investment and only 7% (from 9%) expecting investment would fall. This pushed the net reading on this measure to +31% from +24% previously.

Mr Charteris said the lift had been driven by sheep and beef farmers and horticulturalists.

“Sheep and beef farmers jumped to a net reading of +37% (from +17%) and they now hold the highest investment intent of all the sector groupings.

“Growers’ investment intent was also up to +17% (+5% previously), and horticulturalists and sheep and beef farmers are now looking at upping their investment in areas like on-farm infrastructure and increased livestock/ planting.”

Mr Charteris said dairy farmers investment intent was weaker, but still strong at a net reading of +32% (from +43% previously).

“And amongst dairy farmers saying their investment will increase, one in five said they were looking at a property purchase to expand their farming operation,” he said.

“Investment intent across all farmers is now as high as it’s been at any stage since mid- 2017, and this bodes well for the sector as we move towards 2026.”

Rural land prices

The survey found farmers’ expectations for land prices had also lifted.

“We last asked farmers about land values in the June quarter, at which stage 39% were expecting prices to lift across the next 12 months and 5% expecting prices to fall,” Mr Charteris said.

“Since then, farmers expectations around the land market have strengthened further, with 51% now anticipating prices will rise and only 5% tipping a fall.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.