Global fertiliser markets are entering a new phase of contraction, as rising prices begin to weigh on demand, agribusiness specialist Rabobank says in new research.

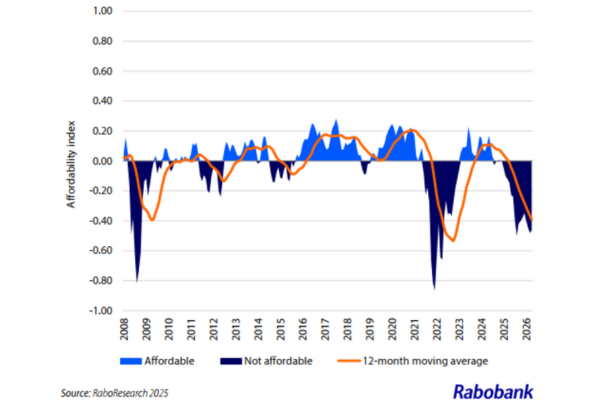

In its recently-released Semi-annual Fertiliser Outlook, the bank’s RaboResearch division says affordability of agricultural fertiliser globally – as reflected in Rabo’s Fertiliser Affordability Index – is clearly beginning to decline.

With agricultural commodity prices having largely remained stable since the start of the year, this decline in affordability is primarily due to an increase in global fertiliser prices, the report says.

Between April 2025 and the end of September 2025, fertiliser prices increased by approximately 15 per cent, RaboResearch said. Phosphates saw an increase of almost 19 per cent in the period.

Rabobank Fertiliser Affordability index

While some regions of the world continue to show resilience when it comes to fertiliser demand, the broader trend points to weakening demand in 2025, and a more pronounced downturn in 2026.

RaboResearch analyst Paul Joules said with the “12-month moving average of the affordability index moving deeper into negative territory”, this confirms the start of a new downcycle in the global fertiliser market.

“This phase closely resembles the previous contraction,” he said, “suggesting the market is entering a prolonged period of reduced consumption.”

Global outlook

Urea consumption is forecast to decline in 2026, the report says, following a sharp price increase that has already triggered demand contraction, particularly in Brazil where farmers are shifting to ammonium sulphate.

Phosphate prices remain high, leading to an expected four per cent drop in global consumption in 2025, with further declines anticipated in 2026. Chinese exports have fallen, while shipments from Morocco and Saudi Arabia have increased. However, overall trade volumes remain subdued, RaboResearch says.

Potash demand, which rebounded in 2024 due to lower prices, is likely to slow again in 2025 as prices rise. Brazil’s plans for record imports may partially offset declines elsewhere, but, if elevated prices persist, global demand is expected to fall in 2026, the report says.

New Zealand

For New Zealand, Mr Joules said, farmers continue to face persistent inflation in prices of farm inputs, including fertilisers.

“However, looking forward, signs of cooling global demand alongside projected New Zealand dollar strength over the next 12-months, could help to ease prices,” he said.

RaboResearch Disclaimer: Please refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.